OGB is Heading to the Nasdaq

Old Glory Bank and Digital Asset Acquisition Corp. Announce Business Combination Agreement to Create a Texas Company to be Publicly Listed on Nasdaq*

The Pro-America Bank Goes Public

Old Glory Bank, serving customers in all 50 states with its pro-America online banking platform, and Digital Asset Acquisition Corporation (Nasdaq: DAAQ) (“DAAQ”), a special purpose acquisition company, announced that DAAQ and Old Glory Bank’s Bank Holding Company have entered into a definitive business combination agreement to create OGB Financial Company, a Texas corporation to be listed on Nasdaq under the reserved ticker symbol “OGB.”

The closing of the transaction is expected to occur at the end of the first quarter or early in the second quarter of 2026 and is subject to approval by the shareholders of the parties and other customary closing conditions, including regulatory approval.

Old Glory Bank is a full-service, digital-first bank with over 80,000 personal and business accounts in all 50 states and several countries. Old Glory Bank has a physical branch in Elmore City, Oklahoma and started serving customers with online accounts in April of 2023. It has since grown deposits more than 2,000% from $10 million to over $245 million as of December 31, 2025.

DAAQ currently has $176 million in its trust account and Old Glory Bank’s pre-money valuation will be $250 million in this transaction. The parties intend to arrange a PIPE or other proceeds of at least $50 million for closing. Additional information about the transaction is provided in a Current Report on Form 8-K [available here] and an investor presentation that will be filed with the Securities and Exchange Commission and will be available at www.sec.gov.

Next-Gen Banking for the DeFi Economy

“America cannot have financial freedom without decentralized finance. That’s why Old Glory Bank supports crypto and decentralized blockchain transactions," says Mike Ring, Co-Founder, President & CEO of Old Glory Bank, "and we were one of the few banks to proudly provide banking services to crypto companies during the Biden Administration, when many of the mega banks cowered and acquiesced to government. We have never cowered to government. Trust me, if the mega banks cowered before, they’ll do it again once the political winds change."

Our next generation will be the unification of daily banking with crypto, giving everyday Americans the freedom of choice in how they spend, save, and invest. Whether you are looking for traditional banking with Savings and Checking, or you are looking for the future of banking, with crypto, stablecoin, and self-custodial wallets combined with your dashboard, Old Glory Bank is the solution.

Our next generation will be the unification of daily banking with crypto, giving everyday Americans the freedom of choice in how they spend, save, and invest. Whether you are looking for traditional banking with Savings and Checking, or you are looking for the future of banking, with crypto, stablecoin, and self-custodial wallets combined with your dashboard, Old Glory Bank is the solution.

Once linked, you can easily “on-ramp” and “off-ramp” US Dollars (fiat) with popular crypto coins, creating a seamless experience to spend fiat and crypto every day.

OGB Customers will be able to use our new stablecoin, OGBUSD, for payments and remittances around the world. Recipients can hold it, spend it, exchange it for U.S. dollars at Old Glory Bank, or convert it on any exchange supporting ERC-20 standard tokens.

OGBUSD will be backed by US Dollars, 1 to 1, so you will always know the value and buying power.

“Old Glory Bank’s holding company already has more than 6,000 patriotic stockholders. This transaction and the related listing on Nasdaq will provide the capital necessary for us to continue growing deposits while ensuring that the great Americans living on Main Street, who we serve from sea to shining sea, can also be owners”

Dr. Ben Carson

Co-Founder and Board Member of Old Glory Bank Holding Company, Former HUD Secretary, Founder and Chairman of the American Cornerstone Institute

Traditional values. Modern Banking.

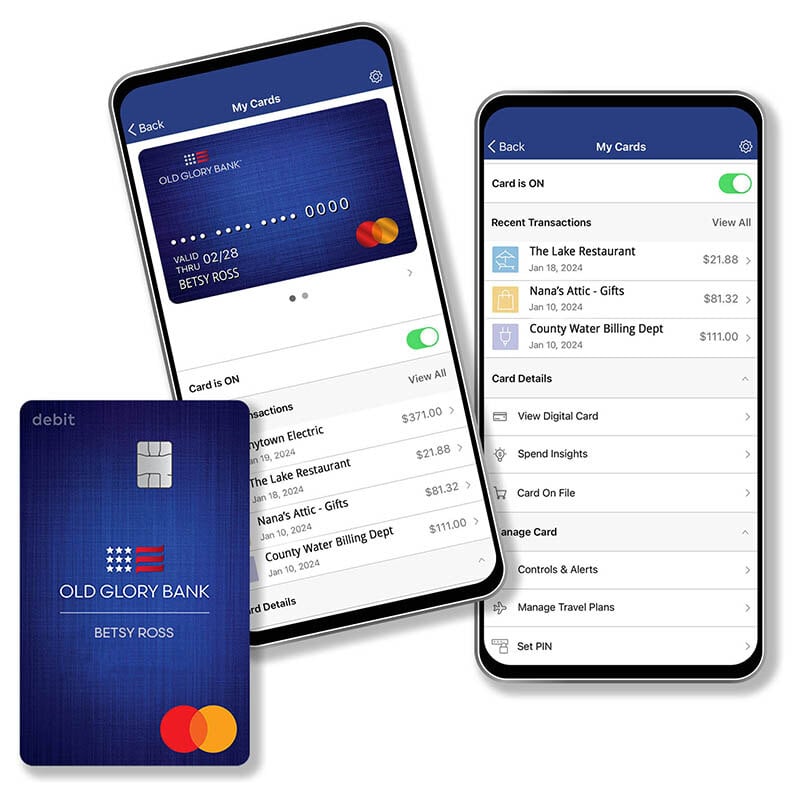

Old Glory Bank became the community bank for all of America by offering the convenience of a nationwide bank combined with the personal service of a local neighbor bank.

- Personal and Business Accounts

- Home Loans and HELOCs, including VA*

- Commercial Lending, including SBA loans*

- 2/3 day early access to qualified direct deposits*

- Over 40,000 free in-network ATMs

- Cash deposits at over 88,000 retail stores

- Charitable Round-Ups

- Old Glory Pay - our proprietary closed-loop payment app

- Old Glory Alliance - cancel-proof crowdfunding for personal causes and political campaigns

“Old Glory Bank is about product, service, and freedom. We have all of the products and features of the mega banks, but we don’t debank people who exercise their Constitutional rights or disagree with government. Administrations change, so it is important to be with a bank that has always been on the right side of banking. There has never been any DEI at Old Glory Bank, only PSL – Privacy, Security, Liberty.”

Sean Spicer

Old Glory Bank Board Member and 30th White House Press Secretary and Television Host

“Old Glory Bank has continued to push back against debanking and continues to support America’s important industries like crypto, firearms, oil and gas, and agriculture. We proudly started offering bank accounts to the crypto community in early 2024, and we never succumbed to the Biden Administration’s Operation Chokepoint 2.0.”

Larry Elder

Co-Founder and Director of Old Glory Holding Company, Radio and TV Host, former California gubernatorial candidate, and former presidential candidate.

Privacy, Security, and Liberty for All

Before the truth of debanking in America hit the news wire, we were already building a fortress for freedom-loving Americans. We saw the cancel-culture trend infiltraing our financial system and got to work.

Together with expert bankers with decades of experience, our co-Founders – Dr. Carson, John Rich, Larry Elder, Sean Spicer, and others – created Old Glory Bank as the market solution to debanking. We didn't wait for any administration to make us play fair. We believe fairness and freedom in banking is every law-abiding American's right.

“Americans should not be scrutinized or tracked for lawful and personal financial transactions. Our upcoming OGBUSD stablecoin will ride on various blockchains, not the Fedwire Funds Service, not the SWIFT network, and not the card networks. Our customers’ money is their business!”

Bill Shine

Co-Founder and Executive Chairman of Old Glory Bank, former Fox Business News President, and White House Deputy Chief of Staff for Communications for the 45th Administration,

Putting Our Heroes First

Old Glory Bank is proud to offer Old Glory Protect – a $100,000 Line-of-Duty Death Benefit, avalable exclusively to Old Glory Bank customers.

Eligible Protectors with a personal Old Glory Bank account and direct deposit* – that is Law Enforcement, First Responders, U.S. Border Patrol Agents, and Active-Duty Military – may register for Old Glory Protect at no cost. It's just one small way we can say, "Thank you for protecting us."

“Of all of the great products and services we offer at Old Glory Bank, what I’m most proud of is Old Glory Protect. We are the only bank that offers to our fearless Protectors who open a free account and bank with us a free $100,000 Line of DutyLine-of-Duty Death Benefit, because without them, we wouldn't have the freedom and opportunity to build something as important as Old Glory Bank.”

John Rich

Co-Founder of Old Glory Bank, Patriot, and Country Music Superstar

More Great Info to Come!

Learn More: